Loading...

9th May 2023

The Four Great Errors

The error of the confusion of cause and effect

The error of false causality

The error of imaginary causes

The error of free will

The Twilight of the Idols, Friedrich Nietzsche

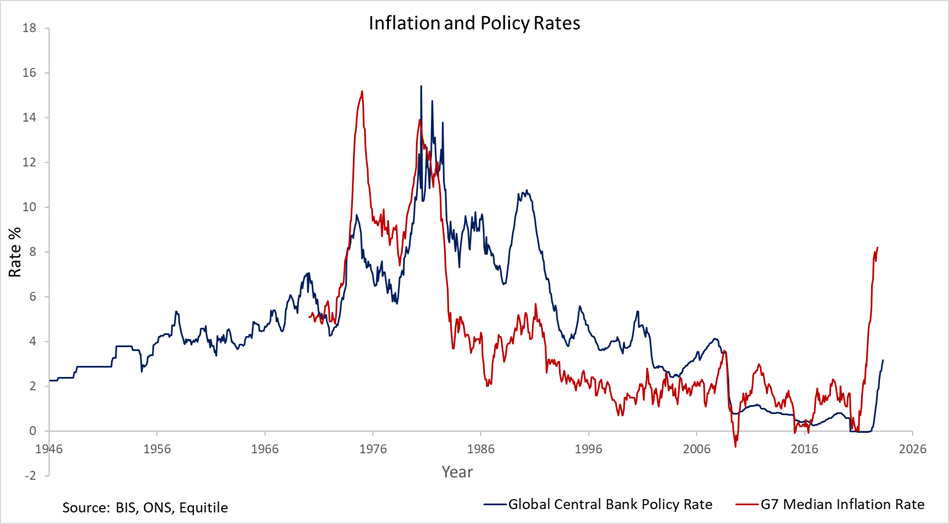

In 1951 Deutsche Bundesbank was the first central bank to be made independent of government control. In 1962 Milton Freidman suggested best practice may be to separate monetary policy from political control. As inflation accelerated through the 1970s and 1980s (see chart) the case for a new approach to monetary policy became more compelling. By the early 1990s there was a widespread trend toward governments handing control of monetary policy to their central banks. Independent central banking, with committees of experts regularly adjusting interest rates to control inflation, is now the accepted best practice for monetary policy.

The move to independent monetary policy was immediately considered a success. As inflation and interest rates began falling through the 1990s confidence in the new regime only grew. From the 1990s onwards falling inflation and falling interest rates fuelled a golden age of economic expansion dubbed, in 2004 by then Fed Governor Ben Bernanke, ‘The Great Moderation’. Alan Greenspan, the Fed Chairman from 1987-2006 presided over this success, becoming a revered celebrity; his biography was titled ‘Maestro’. In Greenspan’s 2004 speech, ‘Risk and Uncertainty in Monetary Policy’, he explained how he had engineered the American boom by implementing what he called his ‘risk management paradigm’. This involved an active interventionist approach to monetary policy aiming to pre-emptively head off any impending recessions.

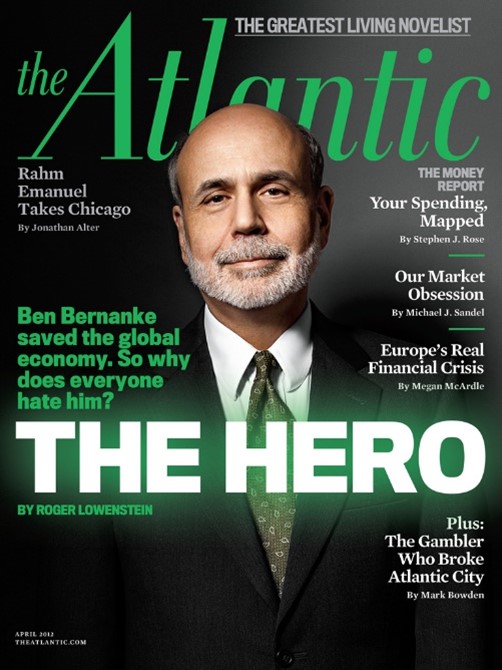

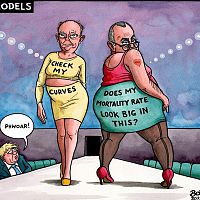

The end of Greenspan’s tenure as Fed Chairman was followed almost immediately by the Global Financial Crisis of 2007-2009. Initially this led to some introspection over both the validity of economic theory and the success of the Fed’s approach to monetary policy. In a 2008 testimony to Congress Greenspan talked of having discovered a ‘flaw in the system’ while in 2009 Paul Krugman asked ‘How Did Economists Get It So Wrong?’ To many, it appeared the Fed’s policies had encouraged the excessive leverage which caused the crisis. However, as the crisis evolved the Fed worked, together with the Treasury, to enact even stronger monetary policy interventions, most notably the Troubled Asset Relief Program or TARP, to counteract the worst effects of the crisis. These interventions were seen as triumphs for successfully resolving the crisis. As a result, the community of central bankers emerged from the crisis not chastened by having caused it but instead emboldened by their successes in fixing it. The 2012 cover of The Atlantic, featuring then Fed Chairman Ben Bernanke, captured the prevailing mood well.

The GFC itself required a sharp lowering of interest rates to help the private sector deal with its bad debts and the state sector to service its higher borrowing requirements. To the surprise of many, the lowering of interest rates and printing of money, required to fund the various support programs, did not generate higher  inflation. Instead, inflation remained stubbornly low after the crisis and policymakers even began fretting about the possibility of the economy sliding into a 1930’s style debt-deflation trap. To counteract this new threat central banks continued pushing interest rates ever lower, their aim being to stimulate extra consumer demand which was expected to push inflation higher.

inflation. Instead, inflation remained stubbornly low after the crisis and policymakers even began fretting about the possibility of the economy sliding into a 1930’s style debt-deflation trap. To counteract this new threat central banks continued pushing interest rates ever lower, their aim being to stimulate extra consumer demand which was expected to push inflation higher.

By the end of 2008 the Fed had cut its base interest rate to almost zero, where it remained until the end of 2015. Other central banks became even more experimental with their post-crisis interest rate policies, daring even to lower them into negative territory. There was much debate ahead of these moves as to whether negative rates were practically possible. Nevertheless, in 2012 the Danish Central bank introduced negative interest rates, followed by Switzerland at the end of 2014, Sweden in 2015 and Japan in 2016. These ultra-low interest rates filtered into the longer-term bond markets. By 2019 there was an estimated $16 trillion worth of bonds trading with negative interest rates. For the first time in history lenders were paying interest to borrowers. In May of 2020 Nestle became the first corporate to issue a bond with negative interest rates.

By 2015 the US was able to tentatively edge away from its zero percent interest rate policy, ZIRP, but other central banks remained seemingly trapped at what was called the zero percent lower bound. Then in 2020, as governments and central bankers were working to fund the cost of lockdown, even the Fed was forced to re-join the zero-rate club.

This extended period of quiescent inflation and ultra-low or negative interest rates fostered new thinking on the part of economists. A remarkable idea emerged suggesting governments could and should borrow without limit. This idea rapidly gained traction in both academic and policy making circles under the name of Modern Monetary Theory or MMT. In essence, MMT argued that governments, who borrow in their own currency, can always print their own money to pay their debts. For this reason, they could safely borrow and spend without limit, never needing to worry about default. This idea was a marked shift from previously accepted wisdom that government spending should be kept broadly in line with its tax income, the balanced budget constraint. The only constraint placed on borrowing by MMT was through inflation; the borrowing must stop when inflation became unacceptably high. But with inflation having been so low for so long and seemingly impervious to either persistently low interest rates, or even the massive money printing of the GFC, this constraint was seen only as a remote hypothetical possibility.

Therefore, in early 2020, when fear over the Covid 19 virus suddenly hit, three important conditions were in place:

1, Deflation appeared a greater risk than inflation.

2, MMT said governments could borrow and spend without limit.

3, Capital markets were willing to lend to governments, at low or negative interest rates, seemingly without limit.

Against this backdrop governments believed they could afford the experiment of shutting down their economies, in the hope of curtailing the spread of the Covid 19 virus. And, in accordance with the logic of MMT, which imposed no limits on government spending, these policies were enacted without cost-benefit analysis.

From today’s conditions of surging inflation, rising interest rates and governments struggling to service their debts, the ideas and financial conditions prevalent just before lockdown seem literally incredible.

As we now know, economies around the world responded very differently to the monetary and fiscal stimulus of the lockdown period compared with the those of the Global Financial Crisis. The GFC proved disinflationary whereas lockdown appears to have triggered persistent inflation.

After lockdown, as governments removed the restrictions on economic activity, inflation surged immediately. Initially its cause seemed clear, manufacturers, hampered by logistical issues and labour shortages, were unable to meet the surge of pent-up-demand as consumers rushed to make purchases they would otherwise have been made during lockdown. This supply-demand imbalance thesis was persuasive for a few months. But as time passed the supply chains were fixed and the pent-up demand was satiated, but the inflation remained. Here in the UK inflation is still holding above 10%, where it has been for almost a year. Something seems to have happened to convert the temporary, post-lockdown, inflation into an ongoing inflationary process.

Central banks responded to the surging inflation by pushing up interest rates. Since lockdown the FOMC has enacted the most abrupt shift in monetary policy on record raising rates from 0.25% in early 2022 to 5.25% today. Inflation is now moderating in the US albeit rather slowly. Elsewhere its fall is so far much less convincing.

One explanation for the persistence of the inflation is that the central bank’s interest rate hikes may be causing rather than curing inflation. This is a disconcerting suggestion because it suggests central banks might have misunderstood how monetary policy influences inflation and therefore may be operating monetary policy the wrong way round!

When central bankers use interest rates to manage inflation, they are implicitly using a model of economic behaviour which goes as follows: raising interest rates discourages consumers from borrowing additional money and forces them to divert more of their income to service existing debts. Conversely lowering interest rates encourage consumers to borrow additional money while lowering the cost of servicing existing debt. Therefore, raising interest rates reduces demand and therefore inflation, while lowering interest rates increases demand and therefore inflation.

This model of inflation responding to interest rate changes is so simple and so intuitive it has become an axiom of monetary policy. It has been adopted as accepted wisdom and is rarely if ever seriously reconsidered. But the model may have a weakness. It may suffer a ‘lump-of-supply fallacy’. It presumes the demand side of the economy is influenced by interest rate changes while the supply side remains largely unaffected.

An alternate model, focussing on the supply side, might go something like this: rising interest rates discourages producers from borrowing money, this curtails production capacity and therefore competitive pressure in the economy, while at the same time imposing higher debt servicing costs. Producers attempt to pass on these higher costs through higher prices and, as competition is less intense, find it easier to do so. Conversely falling interest rates encourages producers to borrow more money to expand production, while at the same time reducing their interest rate costs. Producers can therefore reduce their prices and are compelled to do so by increasing competition. Therefore, raising interest rates tends to increase inflation while cutting them reduces it.

These demand side and supply side models are very similar. They both assume similar responses to interest rate movements but because they focus on opposite sides of the economy, they lead to different expectations for how inflation responds to interest rate changes.

If conventional wisdom is correct and the demand side of the economy is more sensitive to interest rate changes, lowering interest rates should push up inflation. With a lag, this in turn should then push up interest rates back up, which, with another lag, should then push inflation back down again. In other words, if the demand side model is dominant, inflation and interest rates should both be cyclical, but essentially stationary series and should both move, to some extent, out of phase, with one the another.

If the alternate supply side model is dominant, but central banks nevertheless conduct monetary policy according to their demand side model, a very different pattern of behaviour should be expected. A lowering of interest rates should lead to supply side expansion, which in turn will push inflation lower. Central banks will respond with lower interest rates causing a further supply side expansion, another lowering of inflation and so on. Conversely, an increase in interest rates should lead to supply side contraction, pushing inflation higher, causing still higher interest rates. Importantly, this suggests a self-reinforcing or trending behaviour. Once a disinflationary trend is established it will tend to persist until the economy is driven to the zero-rate bound. Once at the zero-rate bound it will become trapped by a disinflationary excess of investment, where it will be stuck until some exogenous shock forces inflation back into the system. Conversely, if an inflationary trend starts it will also tend to be persistent and self-reinforcing again until an exogenous shock reverses its direction.

The journey down to the zero-rate trap will feel like a triumph of moderating inflation, falling rates, rising asset prices and real economic expansion, rather like the great moderation. However, it will terminate in the unhealthy stagnation which gripped Japan after the 1990s.

Which of these models is correct? Does interest rate policy primarily drive the demand side or the supply side? The chart above shows the history of central bank interest rates for the G7 since World War II (blue) together with a global measure of inflation (red). The most striking features of the chart is the long post World War II up-trends in rates and inflation to their peak in the 1980s followed by their long downtrend from the 1990s toward zero, prior to lockdown. This behaviour is consistent with monetary policy acting primarily on the supply side rather than on the demand side of the economy.

Viewed through the supply side model of monetary policy, it is interesting to reconsider the history of interest rates and inflation in the post WWII period. A plausible narrative may be that the end of WWII released an inflationary burst of pent-up demand. Policy makers responded by raising interest rates unnecessarily high thereby preventing the supply side from satiating the higher demand. This situation of high inflation, high interest rates, excess demand and deficit of supply persisted until the 1980s. At this point an exogenous shock hit the economy, for arguments sake let’s assume this to be Reagan-Thatcher reforms, which caused a sufficiently large supply side expansion to reverse the inflationary trend. From there the self-reinforcing disinflationary expansion of the great moderation took hold.

If this supply side is more sensitive to monetary policy than the demand side the current process of raising interest rates may be causing rather than curing inflation. We cannot be certain of this conclusion, but it fits enough of the data to warrant serious consideration. At the very least it suggests we should be more cautious in the application of monetary policy. The US banking system is currently suffering a crisis, this has been caused largely by the unprecedented violence of the swing from ultra easy to ultra tight monetary policies of the last view years. These policy swings and therefore the banking crisis itself may have been unnecessary and counterproductive.

We cannot be sure how the levers of monetary policy influence inflation. If we don’t know what the levers do it might be wisest to tug on them less frequently and less forcefully. An interesting experiment would be to set central bank base rates to say 3% and then to send our monetary policy committees to the seaside for a decade or two. The economy may perform better without an active monetary policy.

***

To join our distribution list, please send ‘subscribe’ to: info@Equitile.com

Dollar Demise?

2

Dollar Demise?

2

Hedonism and the value of money - Part I

2

Hedonism and the value of money - Part I

2

Artificial Intelligence - Scary Good

2

Artificial Intelligence - Scary Good

2

Hedonism and the value of money - Part II

2

Hedonism and the value of money - Part II

2

Modern Monetary Theory - The Magic Money Tree

2

Modern Monetary Theory - The Magic Money Tree

2

Monetary Policy on a War Footing

2

Monetary Policy on a War Footing

2

Crisis Economics

2

Crisis Economics

2

Captain Kirk and the science of economics

2

Captain Kirk and the science of economics

2

An Impossible Trinity?

2

An Impossible Trinity?

2

When Prophecy Fails - How to ignore doomsday forecasts

2

When Prophecy Fails - How to ignore doomsday forecasts

2

When Science Fails

2

When Science Fails

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

Jubilee - A time for borrowers to celebrate?

2

Jubilee - A time for borrowers to celebrate?

2

Luddites and the New Social Revolution

2

Luddites and the New Social Revolution

2

Barney's P Curve - Why we expect higher inflation

2

Barney's P Curve - Why we expect higher inflation

2

0

Register for Updates

12345678

-2

0

Register for Updates

12345678

-2