A Free Lunch

It looks like our argument in a recent blog - that LVMH shareholders were getting a free lunch – seems to have been understated. Bernard Arnault, the company’s driving force, might have made his most transformative deal yet and, moreover, have it mostly paid for by the European Central Bank.

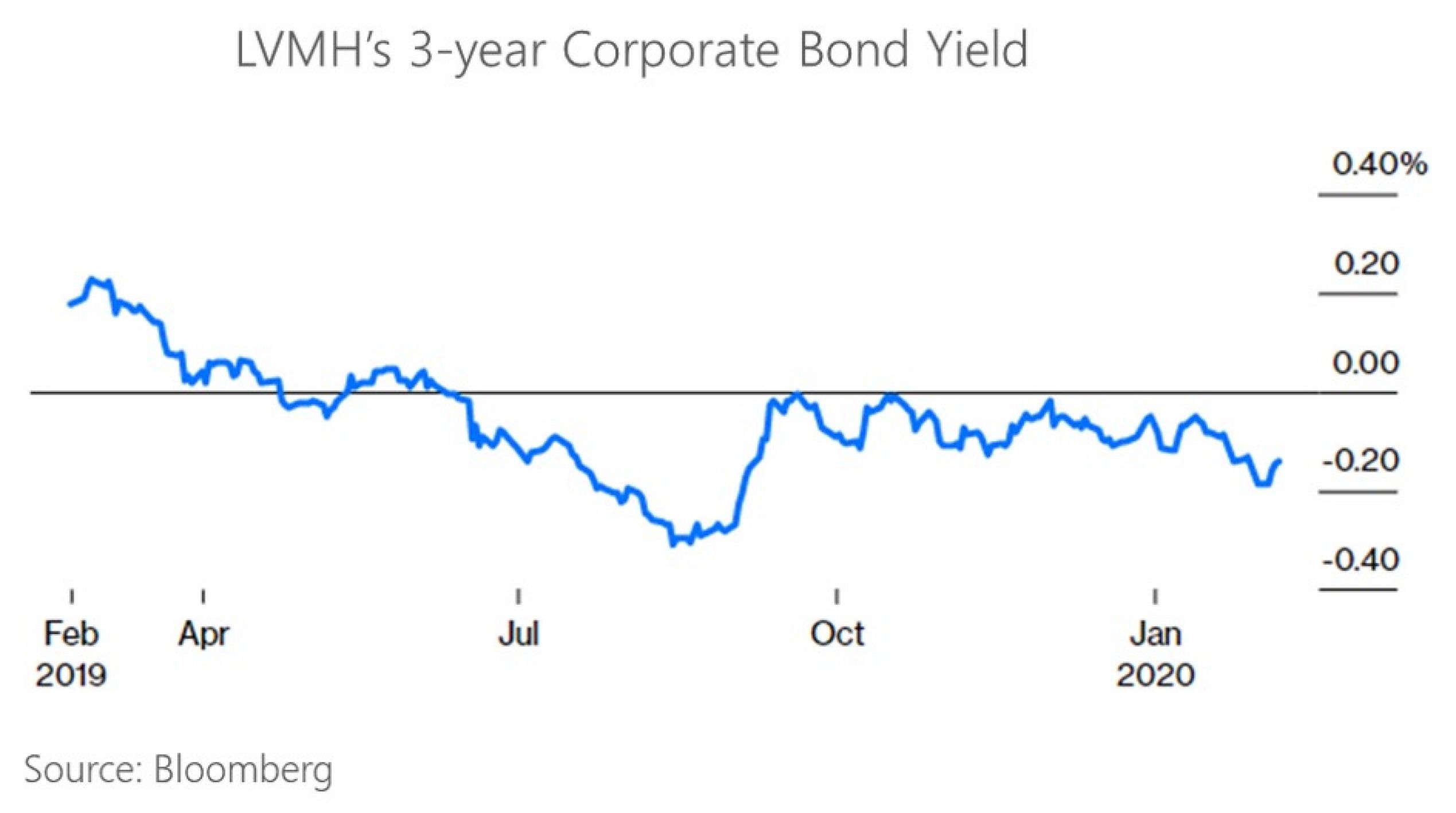

Whereas our previous calculation (see our December 2019 comment) assumed 0.5% cost of debt funding for the Tiffany acquisition, the first EUR 9.5bn (of EUR14.5bn acquisition cost) has been locked in at even better rates through ECB’s Corporate Sector Purchasing Program. The issuance announced this week consists of five tranches; two of which carry negative yields. Even the longest maturity, an 11-year bond, has a coupon of no more than 0.45%. All in, this is around half of the price LVMH was expecting to pay when the structure of the deal was first laid out late last year.

So, what we thought would be an annual funding cost of EUR 73 million will now be somewhere between EUR 44m and 65 million. Trivial considering LVMH’s shareholders are accruing EUR 500-600 million of additional cash flow.