All Pent-Up

It doesn’t look like the permitted re-opening of retail stores in the UK has marked a rush back to the shops. One might have expected people to be cautious in the first week or so but even in week two the footfall in England and Northern Ireland was still down 53.1% on the same week the year before (Springboard). It’s hard to say how quickly confidence builds from here, especially in light of an impending sharp rise in unemployment once the government’s furlough scheme comes to an end. One thing is clear though - there’s no shortage of cash right now.

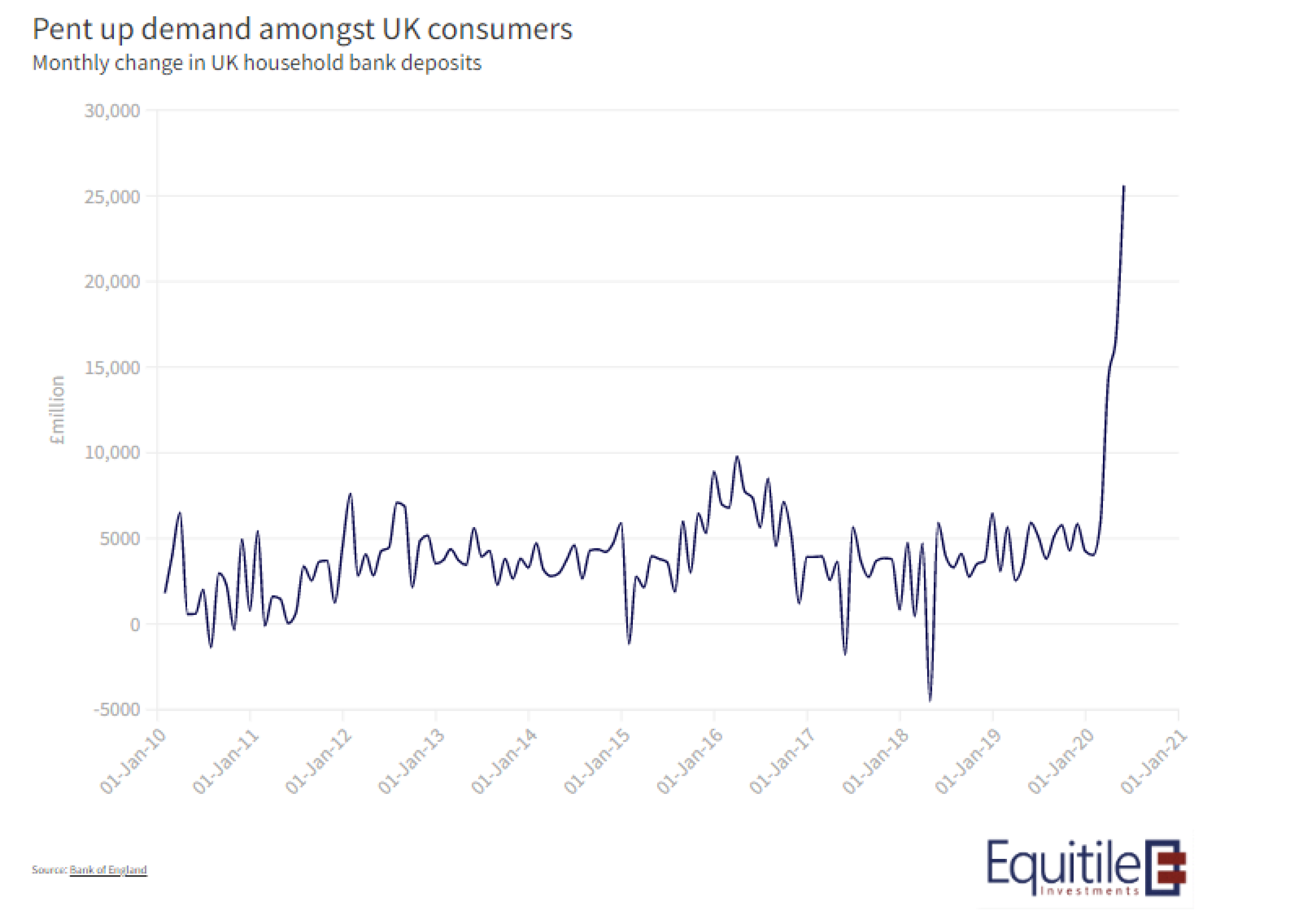

The Bank of England published data last week showing the sharp increase in retail bank deposits. There’s a startling build up of saving as those with an income spent more than 100 days, with the exception of Amazon and grocery stores, with no where to spend.

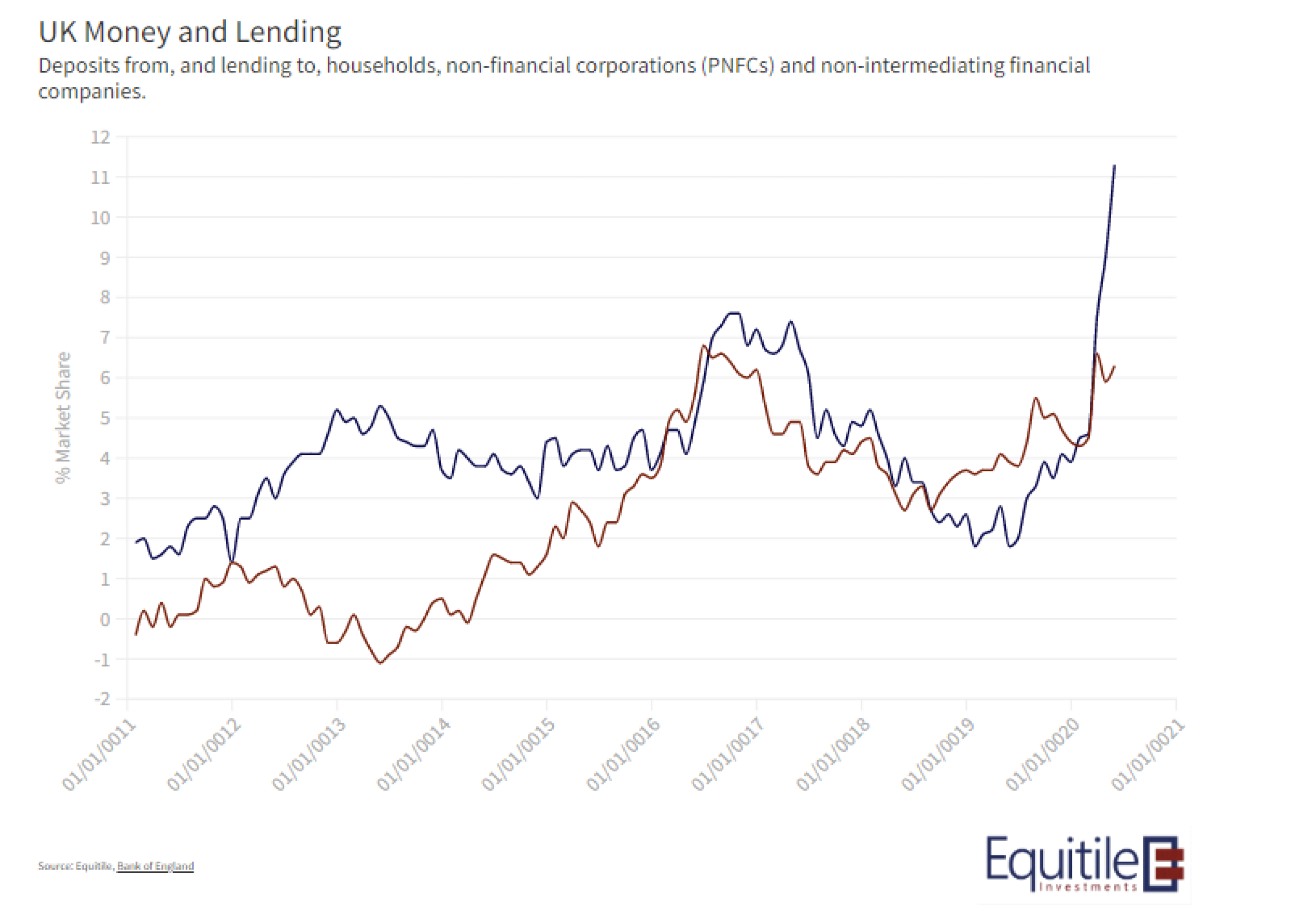

Wherever you look, there’s been a significant improvement in consumers’ balance sheet in aggregate. In fact, taking both consumer and companies together, saving has been significantly higher than borrowing for some weeks.

It can’t go on forever of course, Keynes’ so-called Paradox of Thrift can soon take hold. For now though, those left with an income have plenty of financial capacity to fulfil their pent-up demand.