Organic Matters

Warren Buffett, in his ever-humble way, mused this week that he had overpaid when he teamed up with private equity firm, 3G Capital, to fund the Heinz acquisition of Kraft in 2015. The 27% fall in Kraft Heinz’ share price last Friday was a big hit for Berkshire Hathaway who, on the face of it, had found a new strategy for deploying capital - a pressing problem given its significant and growing cash pile.

In many ways the collapse is surprising. A global player with a portfolio of leading brands should, in theory at least, offer a quiet life for long-term holders like Buffett. By selling products we consume every day into a growing population, companies with negative earnings surprises this large shouldn’t really feature.

The world is changing in all respects however and eating habits are no exception. Processed packaged food, a core segment for Kraft Heinz, no longer has the same tailwind it did. A cursory look at the global food mix brings this structural change into sharp relief. Kraft Heinz has been using old brands to roll out new products such as Mayochup, but a structural shift in the food industry indicates they might be focusing on the wrong sauce.

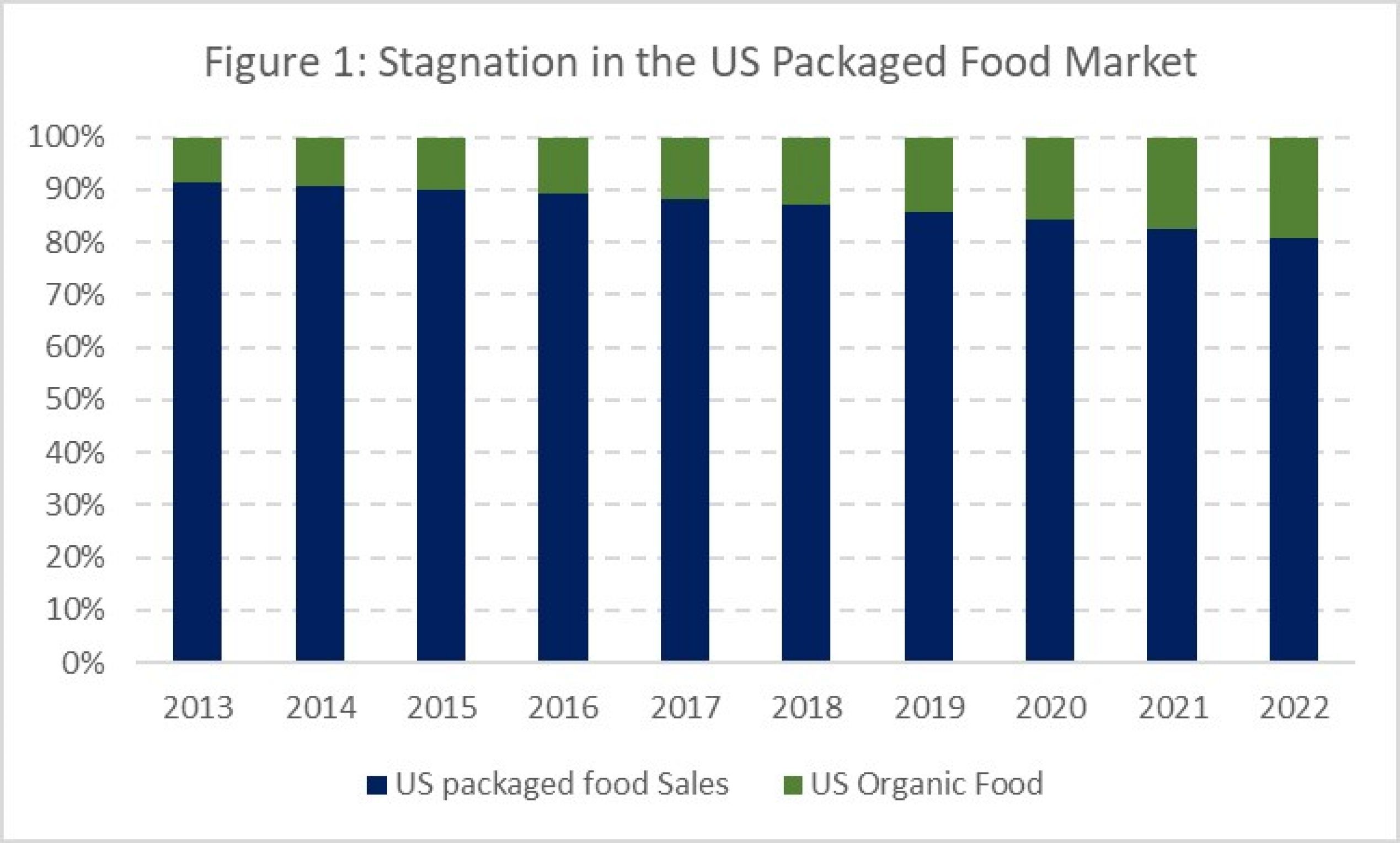

Figure 1 below shows the US packaged food market in structural decline relative to healthier preferences. The market has been growing at just 2% over the last few years while the organic food segment has been growing at six times that rate.

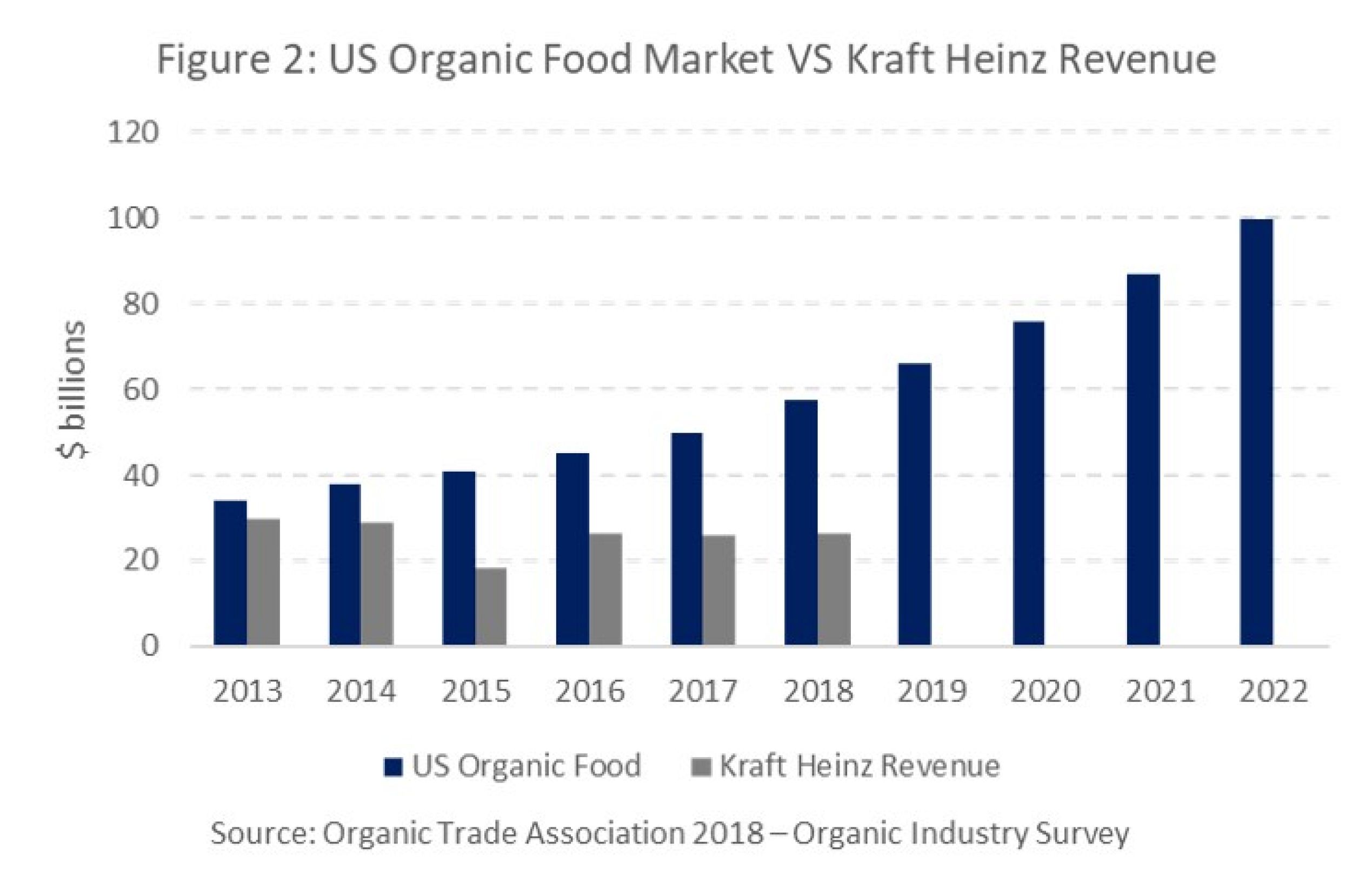

Figure 2 shows the US organic food market in dollar terms against Kraft Heinz’s stagnating revenue, we believe this is core to their challenge, and the future projections remains bleak.

Now Kraft revealed additional, more specific, problems last week. The merger hasn’t been handled well from an operational perspective, manufacturing and logistics costs are higher, goodwill write-offs were much bigger than expected and they announced a pending SEC investigation into their accounting policies. The structural shift in consumer habits, however, offers a more interesting lesson - the buy-and-hold mantra that pervades much of the investment industry is being challenged, even in traditionally stable industries.

Quickening dynamics in all markets are making business life more challenging than ever, not only for companies managing a merger on the scale of that between Kraft and Heinz, but for all companies large and small. From an investment point of view, betting on indefinite success – even in the most stable industries - is becoming a dangerous game.