Loading...

4th February 2022

The spectre of inflation has spooked stock markets since the end of last year with headline rates in the US for example above 7% – the highest since 1982. The Bank of England this week suggested that the UK will see a similar rate by April.

There are clear reasons why this inflationary impulse has occurred. Central banks around the world have supported a significant increase in deficit spending through the purchase of government debt and so we have witnessed the biggest Keynesian stimulus since World War Two. The Federal Reserve has more than doubled the size of its balance sheet since the outbreak of COVID-19. Moreover, this massive monetary expansion has been accompanied, for the first time in history, by government policies to shut down large sectors of the economy and impose working practices that have made it impossible for businesses to function as normal.

The outcome has been supply-chain disruption such as we have never seen which, as economies have opened, has led to both price and wage pressure throughout the system. Commodity and basic materials have seen prices up 20-80% from their lows and wages in some sectors, especially hospitality, have been rising at more than 10% p.a.

There are signs that some of this pressure may be about to ease. Industrial production is stabilizing back to pre-pandemic levels, shipping rates are now collapsing, and basic material prices are rolling over (except oil and gas). There are also signs that wage pressure isn’t compounding quite as much as feared as labour participation rates pick up.

We wouldn’t want to get too confident on the inflation front but if it is close to a peak, what would this mean for investors?

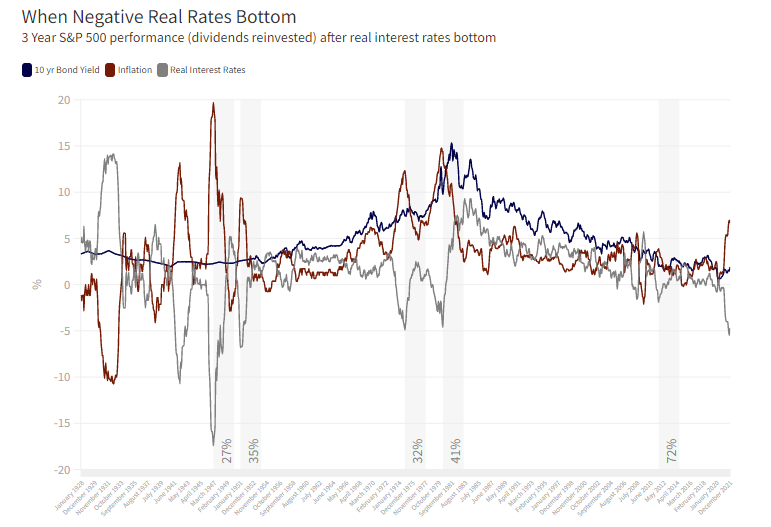

Although several interest rate hikes from the Federal Reserve are now priced in and bond yields have moved up this year, we still face the most negative real (inflation adjusted) yields since the 1970s.

Looking through a long lens in this chart going back to 1928, when negative yields have reversed it’s been because inflation has fallen sharply, not because bond yields have risen.

Once that reversal happens and real negative yields bottom out, it’s generally been a good time to buy the stock market with a long-term view. The grey bars on the chart show the ensuing 3 years market performance from the month that real rates turn.

29th June 2021

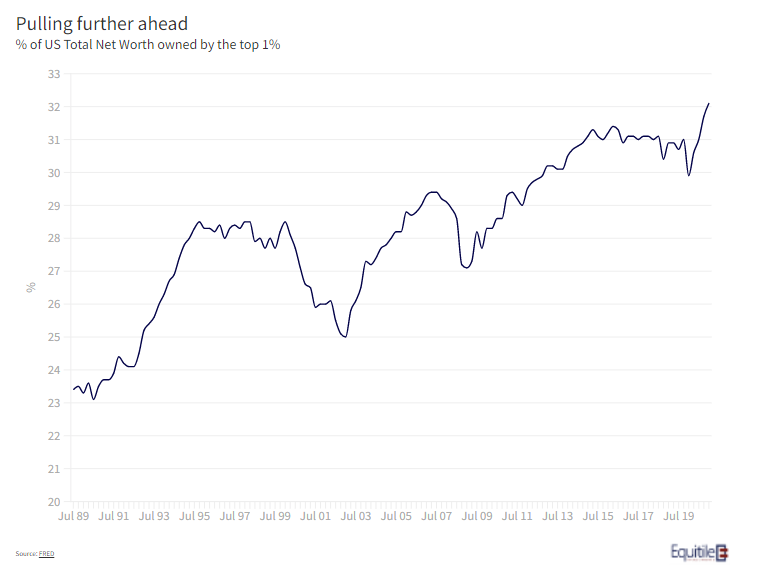

We have written a great deal over the last few years on the wealth polarising effect of monetisation. Given the significant increase in the Federal Reserve’s balance sheet through the COVID19 lockdowns, therefore, it should come as no surprise that the portion of net worth owned by America’s wealthy has increased again – nearly a third of all net worth in the US is in the hands of the Top 1% (see figure 1).

The most often cited cause of this is the Fed’s impact (although they largely deny this) on the price of assets held mainly by the well-off. There are, however, more subtle drivers too. The swings seen in asset markets, due to both COVID in 2020, and the longer-term effect rising leverage has on market volatility, has made it more difficult for the less-well off to hold on. In a bear market, as John Pierpont Morgan somewhat cynically pointed out, “stocks return to their rightful owners” and so if bear markets come more often and more sharply, then the rate of repatriation will only accelerate.

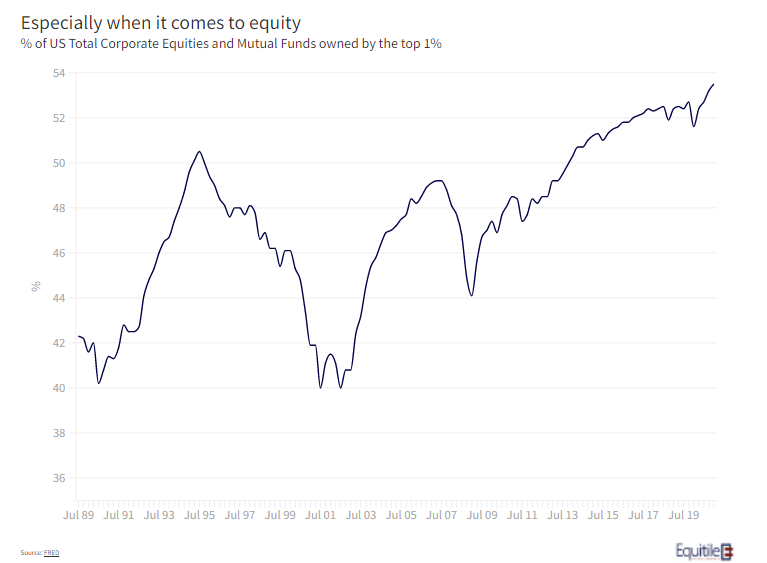

This might explain why, as shown in figure 2, the ownership of corporate equities and mutual funds in the US has become even more concentrated than for other forms of wealth. More than a half of all business equity, held either directly or indirectly, is held by the top one per cent of all owners. A trend that looks set to accelerate.

It may not only come down to the capacity to sustain losses, however. As in all western countries, good advice comes at a price. At Equitile we are not financial advisers but we talk to many advisers through the course of our business. As we see it, the crucial value of a good adviser is support and encouragement when the market has a set-back. A good adviser is in the best position to help investors overcome their natural behavioural aversion to loss, and to help plan their broader finances to make this easier. With good personal advice now scarce and expensive for those of lesser means, the ability to sustain losses floats ever upwards.

One intriguing move by the top 1% is their move away from bonds. Their holdings of debt assets (figure 3) has fallen from more than 60% to 40% of all debt assets in the last two decade - they sold aggressively throughout the COVID crisis.

With real interest rates in the US the most negative since the 1970’s, the potential for capital destruction through financial repression, for bond holders at least, is rising sharply. Perhaps the top 1% know this instinctively, or perhaps they are just better advised.

18th March 2021

Yesterday’s FOMC statement is important (March 17th 2021).

There are three points worthy of note:

1: “the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time”

This is a commitment to the ‘make up strategy’ whereby the Fed seeks to achieve higher future inflation to make up for previously having failed to achieve its desired 2% inflation target. From the FOMC’s perspective, this narrative provides the flexibility keep interest rates extremely low even if it becomes manifestly clear it is failing to maintain inflation at or below its 2% target. This is, as explained by the following passage, now the FOMC’s goal:

2: The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

The FOMC’s goal is first to achieve a negative real interest rate of at least 2% and then to maintain that negative interest rate for ‘some time’. In other words, the FOMC would like to see the spending power of money, saved in the government bond markets, falling by at least 2% per year for the foreseeable future. In order to achieve this the committee is making an open-ended and asymmetric commitment to balance sheet expansion, arguably a euphemism for debt monetization:

3: Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals.

In our view, FOMC is being both honest and pragmatic, effectively admitting the cost of the economic lockdown policies of 2020 and 2021 can only be funded through the printing press. As a result, we believe we are already in the early stages of an uptrend in inflation which will likely last several decades.

We expect the inflation trend to be maintained and accelerated through monetary and fiscal policy coordination; governments will continue spending far beyond their means and central banks will continue ‘footing the bill’ with monetization and negative real interest rates. If so, the global government bond markets will cease to be a viable long-term savings vehicle for the private sector.

8th February 2021

Silvana Tenreyro, one of the external members of the Bank of England’s Monetary Policy Committee gave an important speech on January 11th titled Let’s talk about negative rates.

The content of the speech itself it not especially ground-breaking. As the title suggests it is a discussion of the pros and cons of the Bank of England pushing short term interest rates into negative territory. Nevertheless a few passages are noteworthy.

First there is a reminder that the Bank of England is already doing the work to ensure negative interest rates can be implemented in the British banking system:

“the Bank of England began structured engagement with firms on operational considerations regarding the feasibility of negative interest rates…Once the Bank is satisfied that negative rates are feasible, then the MPC would face a separate decision over whether they are the optimal tool to use to meet the inflation target given circumstances at the time.”

Then there is a longer section explaining how successful negative interest rates have been in other countries:

“the ‘financial-market channels’ of monetary policy transmission have worked effectively under negative rates in other countries …the evidence from experiences of negative rates in other countries suggests that ‘bank-lending channels’ of monetary policy transmission have also been effective at boosting lending and activity”

“· Financial-market channels appear to be unimpeded under negative rates, and some may even be stronger than usual.

We are not persuaded of the benefits of negative interest rates.

We remain concerned over the negative impact negative rates have on the banking sector. As Silvana Tenreyro notes negative interest rates were implemented in the Eurozone in 2014, since then the index of European bank stocks has fallen by approximately 45% in value. Over the same period a similar index of US bank stocks has risen by approximately 50%.

We are also unpersuaded negative rates help stimulate the real economy. Economists argue lower rates drive asset prices higher, boosting borrowing and thereby economic activity. We find this argument persuasive but only up to a point. In our view it is important to recognise much savings are effectively non-discretionary. The savings people put aside for the purpose of house purchases and to fund their retirement are driven by necessity rather than choice. To the extent lower interest rates boost the price of assets and lower the income from those assets the policy means people must divert more of their income toward savings and away from consumption, causing a drag on economic activity.

A simple thought experiment on the topic of negative interest rates is worth pondering:

Case A: You wake up one morning to find the bank has made a terrible error, paying you 100% interest. The money in your bank account has doubled overnight.

Case B: You wake up one morning to find the bank has made a terrible error, charging you 100% interest. The money in your bank account has vanished overnight.

In which of these two scenarios do you increase your spending? To economists focussing on capital market effects negative interest rates look like a stimulus. To savers, worried about banks withdrawing money from their accounts, negative interest rates look like the opposite of a stimulus.

The discussion of negative interest rates in the speech is entirely concerned with the effect on the private sector economy. In our view this misses the true purpose of negative interest rates which is largely to augment government finances.

The main beneficiary of negative interest rates are governments which can issue bonds with negative yields and get paid, by their central bank, with newly printed money, for doing so. In other words, negative interest rates could be viewed as a thinly veiled mechanism of enabling monetised deficit spending. Given the extraordinary level of government spending, caused by the economic lockdown, the pressure on the Bank of England to facilitate monetised deficit spending has grown dramatically in the last year.

In summary, we view recent comments by Bank of England officials as preparing the groundwork for negative interest rates. Investors and savers should take note and consider their own response. Although we disagree with the Bank’s sanguine assessment of the impact of negative interest rates on the real economy and banking sector, we agree such a policy is likely to cause further asset price inflation.

2nd July 2020

It doesn’t look like the permitted re-opening of retail stores in the UK has marked a rush back to the shops. One might have expected people to be cautious in the first week or so but even in week two the footfall in England and Northern Ireland was still down 53.1% on the same week the year before (Springboard). It’s hard to say how quickly confidence builds from here, especially in light of an impending sharp rise in unemployment once the government’s furlough scheme comes to an end. One thing is clear though - there’s no shortage of cash right now.

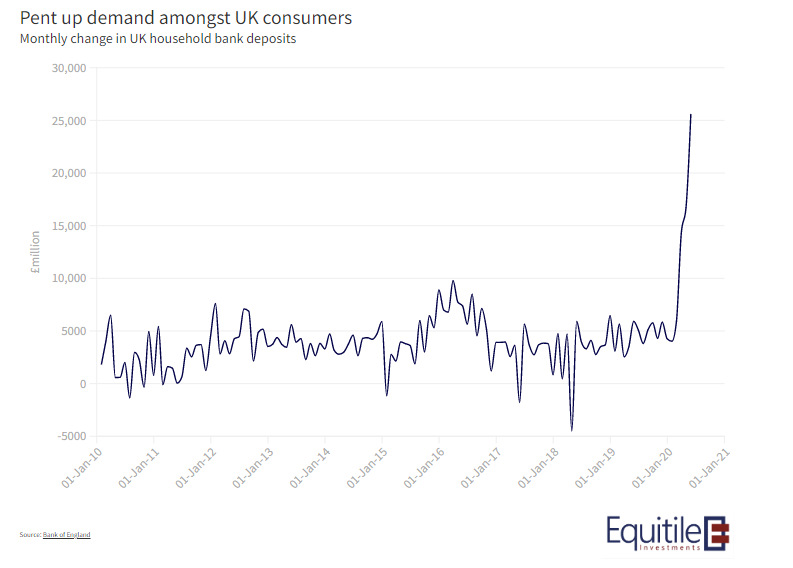

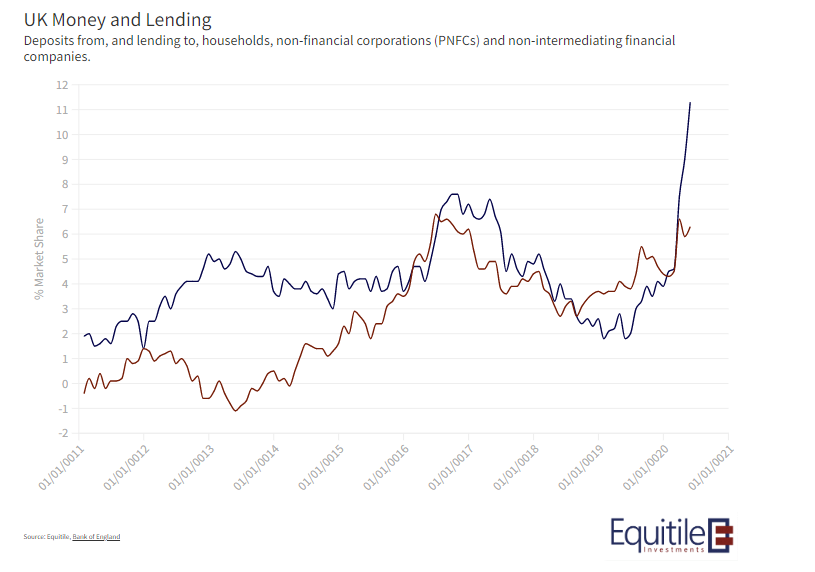

The Bank of England published data last week showing the sharp increase in retail bank deposits. There’s a startling build up of saving as those with an income spent more than 100 days, with the exception of Amazon and grocery stores, with no where to spend.

Wherever you look, there’s been a significant improvement in consumers’ balance sheet in aggregate. In fact, taking both consumer and companies together, saving has been significantly higher than borrowing for some weeks.

It can’t go on forever of course, Keynes’ so-called Paradox of Thrift can soon take hold. For now though, those left with an income have plenty of financial capacity to fulfil their pent-up demand.

2nd December 2019

A visit to Tiffany’s would, to most of us, prove an expensive affair but the breakfast Antonio Belloni, Group Managing Director at LVMH, had with Tiffany’s CEO early in October will be the most lucrative one he’ll have this year. The European luxury conglomerate will overtake Switzerland’s Richemont as the leading player in high-end jewellery after it completes a EUR 14.6 billion takeover of Tiffany in 2020 – building on its position as global leader when it comes to fashion & leather goods, fine spirits and luxury boutique hotels.

The deal becomes most interesting, however, when one looks at the funding of it.

LVMH will acquire Tiffany by issuing corporate bonds at ultra-low rates. With their current 2024 bond yielding minus 12bps, the opportunity for the company to lock in long-term funding costs of close to zero is clear. Even bonds issued by LVMH with a 10 or 15 year maturities will yield next to nothing. Despite the low yield, they won’t struggle to find demand however - the company issued a EUR 300 million tranche with a negative yield in March this year and the deal was six times oversubscribed.

Even if longer-term funding costs were, say, 50bps - realistic in a world where USD 10 trillion of debt has negative yields and the combined entity will still only have net debt/EBITDA of 1.6x – LVMH will pay EUR 73 million annually to bondholders in return for Tiffany’s annual estimated operational cash flow of EUR 500-600 million.

In effect, the bondholders who are paying for Tiffany are bound to lose money, in real terms, while the shareholders of LVMH will extract a net annual cashflow EUR 430-530 million. And that’s before the growth - there are already material plans to expand in China and Japan, markets where LVMH has proven success (Tiffany has remained largely an American brand).

LVMH’s customers, of course, are the sort of people who own shares in LVMH. As central banks keep interest rates close to zero, assets like Tiffany can be bought at virtually no cost to the acquirer’s shareholders who, in turn, have more to spend on expensive handbags and jewellery.

It’s a textbook case of how wealth polarization works in practice in the current monetary environment. As an investor, in this case at least, it’s a chance to be on the right side of it.