Loading...

4th February 2022

The spectre of inflation has spooked stock markets since the end of last year with headline rates in the US for example above 7% – the highest since 1982. The Bank of England this week suggested that the UK will see a similar rate by April.

There are clear reasons why this inflationary impulse has occurred. Central banks around the world have supported a significant increase in deficit spending through the purchase of government debt and so we have witnessed the biggest Keynesian stimulus since World War Two. The Federal Reserve has more than doubled the size of its balance sheet since the outbreak of COVID-19. Moreover, this massive monetary expansion has been accompanied, for the first time in history, by government policies to shut down large sectors of the economy and impose working practices that have made it impossible for businesses to function as normal.

The outcome has been supply-chain disruption such as we have never seen which, as economies have opened, has led to both price and wage pressure throughout the system. Commodity and basic materials have seen prices up 20-80% from their lows and wages in some sectors, especially hospitality, have been rising at more than 10% p.a.

There are signs that some of this pressure may be about to ease. Industrial production is stabilizing back to pre-pandemic levels, shipping rates are now collapsing, and basic material prices are rolling over (except oil and gas). There are also signs that wage pressure isn’t compounding quite as much as feared as labour participation rates pick up.

We wouldn’t want to get too confident on the inflation front but if it is close to a peak, what would this mean for investors?

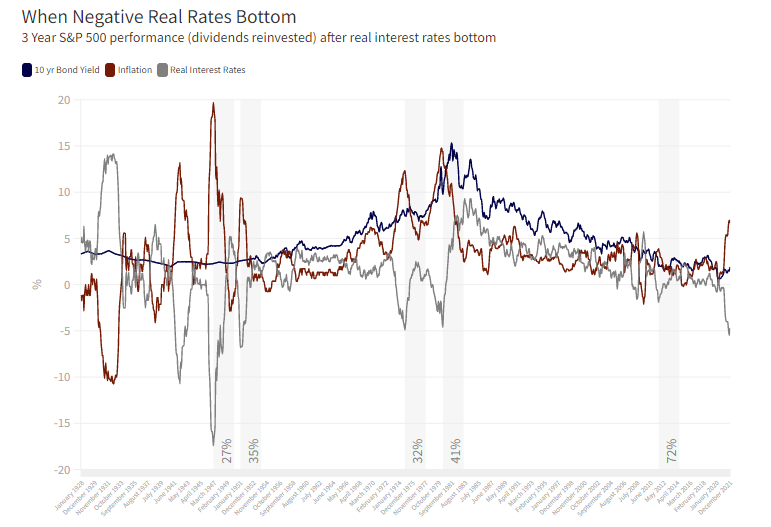

Although several interest rate hikes from the Federal Reserve are now priced in and bond yields have moved up this year, we still face the most negative real (inflation adjusted) yields since the 1970s.

Looking through a long lens in this chart going back to 1928, when negative yields have reversed it’s been because inflation has fallen sharply, not because bond yields have risen.

Once that reversal happens and real negative yields bottom out, it’s generally been a good time to buy the stock market with a long-term view. The grey bars on the chart show the ensuing 3 years market performance from the month that real rates turn.

18th March 2021

Yesterday’s FOMC statement is important (March 17th 2021).

There are three points worthy of note:

1: “the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time”

This is a commitment to the ‘make up strategy’ whereby the Fed seeks to achieve higher future inflation to make up for previously having failed to achieve its desired 2% inflation target. From the FOMC’s perspective, this narrative provides the flexibility keep interest rates extremely low even if it becomes manifestly clear it is failing to maintain inflation at or below its 2% target. This is, as explained by the following passage, now the FOMC’s goal:

2: The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

The FOMC’s goal is first to achieve a negative real interest rate of at least 2% and then to maintain that negative interest rate for ‘some time’. In other words, the FOMC would like to see the spending power of money, saved in the government bond markets, falling by at least 2% per year for the foreseeable future. In order to achieve this the committee is making an open-ended and asymmetric commitment to balance sheet expansion, arguably a euphemism for debt monetization:

3: Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals.

In our view, FOMC is being both honest and pragmatic, effectively admitting the cost of the economic lockdown policies of 2020 and 2021 can only be funded through the printing press. As a result, we believe we are already in the early stages of an uptrend in inflation which will likely last several decades.

We expect the inflation trend to be maintained and accelerated through monetary and fiscal policy coordination; governments will continue spending far beyond their means and central banks will continue ‘footing the bill’ with monetization and negative real interest rates. If so, the global government bond markets will cease to be a viable long-term savings vehicle for the private sector.

18th December 2019

SHARES Magazine's 2020 Outlook edition has an article explaining how we invest at Equitile.

2nd December 2019

A visit to Tiffany’s would, to most of us, prove an expensive affair but the breakfast Antonio Belloni, Group Managing Director at LVMH, had with Tiffany’s CEO early in October will be the most lucrative one he’ll have this year. The European luxury conglomerate will overtake Switzerland’s Richemont as the leading player in high-end jewellery after it completes a EUR 14.6 billion takeover of Tiffany in 2020 – building on its position as global leader when it comes to fashion & leather goods, fine spirits and luxury boutique hotels.

The deal becomes most interesting, however, when one looks at the funding of it.

LVMH will acquire Tiffany by issuing corporate bonds at ultra-low rates. With their current 2024 bond yielding minus 12bps, the opportunity for the company to lock in long-term funding costs of close to zero is clear. Even bonds issued by LVMH with a 10 or 15 year maturities will yield next to nothing. Despite the low yield, they won’t struggle to find demand however - the company issued a EUR 300 million tranche with a negative yield in March this year and the deal was six times oversubscribed.

Even if longer-term funding costs were, say, 50bps - realistic in a world where USD 10 trillion of debt has negative yields and the combined entity will still only have net debt/EBITDA of 1.6x – LVMH will pay EUR 73 million annually to bondholders in return for Tiffany’s annual estimated operational cash flow of EUR 500-600 million.

In effect, the bondholders who are paying for Tiffany are bound to lose money, in real terms, while the shareholders of LVMH will extract a net annual cashflow EUR 430-530 million. And that’s before the growth - there are already material plans to expand in China and Japan, markets where LVMH has proven success (Tiffany has remained largely an American brand).

LVMH’s customers, of course, are the sort of people who own shares in LVMH. As central banks keep interest rates close to zero, assets like Tiffany can be bought at virtually no cost to the acquirer’s shareholders who, in turn, have more to spend on expensive handbags and jewellery.

It’s a textbook case of how wealth polarization works in practice in the current monetary environment. As an investor, in this case at least, it’s a chance to be on the right side of it.